Hi all,

I have recently been accepted into the MicroCapClub investors club, an investor platform where members can share ideas. Membership is usually gained through paid yearly subscription unless you have submit a small cap research submission that is approved by the current members. Please find my submission below.

Please note I have invested in Anexo Group at £0.60 and will continue to monitor the company and post updates here as they become available.

Anexo Group Price: £0.60 S/O: 117.5m Market Cap: 70m

Anexo Group is a market leader in the niche, specialist industry of credit hire and legal services in the UK. Anexo Group provides replacement vehicles and legal services to customers with no means, which have been in a not-at-fault accident, along with some additional business lines.

Anexo Group listed in 2018 and soon after the share price reached highs £1.93 but has since languished currently plateauing at £0.60, all the while growing revenues 25% per year. Anexo has operated and grown the credit hire portion of the business consistently for a decade, but more recently has expanded its legal services division to include supplementary high margin activities including housing disrepair and specialist emissions cases. Anexo is market leading and controls 2-3% of an industry where competitors are actively reducing. Management has strong insider ownership; however, the majority shareholder is a Private Equity firm DBay Advisers.

Trading at a P/E of 3.6x, the market has punished Anexo year to date, currently down 45%. Factors causing the decline are a mix of a one-off incident in the Credit Hire business that had minimal earnings impact, an underwhelming settlement in the VW Emissions case and a strategy reformation communicated by management at the beginning of the year. 2023 earnings have been forecasted to decline; however, I believe that the changes being implemented will put Anexo in a position to increase and stabilize cash flow from operations, improve margins, return on invested capital, and reduce outstanding debt. The runway for new business opportunities remains large and if management can successfully implement the above, assuming 2024 EPS returns to .17, reinstatement of the 2.5% dividend yield and multiple expansion from 3.6 to 7, there is a pathway to a share price of £1.40 or upside of 125%.

Having recently spoken to management I am optimistic on the opportunity; however, I must note, UK equity market sentiment remains very weak.

Company Overview

Anexo Group is made up 3 segments, Credit Hire, Legal Services & Housing Disrepair. The business is also engaging in specialty legal cases which I will touch upon later.

Credit Hire

Anexo operates through a self-cultivated extensive network of mechanics across the UK which refer cases to company. Once the claimant has expressed interest in undertaking a case, a replacement car is provided to the plaintiff and the case is then referred to Anexo Group’s internal legal team - Bond Turner. Once the case is settled, the replacement vehicle is returned and all fees attributable to the incident including rental and legal are paid to Anexo Group.

As will be discussed throughout, the most unattractive & difficult nature of the business is the cash conversion cycle, cases while straight forward, often can take up to 400 days to be resolved. As a result of providing vehicles to claimants, the Credit Hire segment is an absorption of cash and the lowest margin segment of the business. During 2022 there were 7,922 cases settled for an average of £9.4m per case, excluding legal fees. Anexo commands a fleet of vehicles-on-hire that facilitates the number of cases the company can take on, over the past 5 years, the number of vehicles-on-hire has grown from 815 - 2,366. Although expanding vehicles-on-hire will lead to higher revenues in the medium-term, it is a use of cash in the near-term and has been detrimental to the company's ability to report positive OCF. Even though net income has grown at approximately 9% per year, the lack of visibility around free cash flow generation has likely hurt share price performance.

Management manages working capital carefully as evidenced by the businesses ability to pay a consistent dividend, however, through a recent discussion with management it has been made clear the need for the business to demonstrate consistent positive yearly cash flow. Internal discussions have taken place and out is believed the appropriate balance of active vehicles-on-hire (cash outflows) is around the 2,000-vehicle mark. This number should allow the business to continue to grow, whilst limiting ongoing related costs and allowing for the reporting of positive operating cash flows moving forward.

Legal Services

Earlier I discussed the referral wheel between Credit Hire and Legal services, once the vehicle is in the hands of the not-at-fault, legal services undertake all related activities in the efforts to reach case settlement. As it stands, management believe the backlog of cases to be close to 21,000. Anexo Group’s focus from 2022 on-wards has been expanding the Legal Services division, Bond Turner.

With a vast volume in backlogged cases and new cases generated via fleet of 2,000 active vehicles, the avenue to increase cash collections is through expanding the current number of senior fee earners. Since 2018 , employee count has increased from 444 to 678 and in-turn cash collections have steadily increased and should continue to do so in coming years. Another factor that should aid legal services in the expedition of cash collection is the re-opening of the court system within the UK. The settlement of cases and therefore cash collection, is reliant on the speed of the court system. Anexo believes the pace of clearances which has been a headwind to the business due to COVID-19 is showing signs of easing and should become a tailwind into 2024.

Within Credit Hire and Legal Services, Anexo is operating within a niche segment and as such there is limited availability of lawyers with the required knowledge and experience. As a result of this, Anexo has begun operating the Anexo Academy, in which it provides a training pathway for professionals to gain experience and secure employment within the company.

Housing Disrepair

Housing disrepair is an operating segment that has only recently been added to the Anexo Legal Services line. Within the UK there is approximately four million properties for let with a substantial portion currently in a state unfit-for-purpose. Anexo has been vocal on the growth opportunities within the segment and as this becomes a larger portion of the annual revenue should have a substantial effect on the return on capital for the business and improve margin profile. Cases within housing disrepair unlike credit hire, can be finalized within 120-150 days, and often incur an investment of £2,000 for a minimum return of £4,000, 100% margin. Another benefit that has become evident within the segment, is the unwillingness of owners to action the required changes requested by the court within the allotted 3 months. Management is finding upwards of 50% of cases settled are being brought back to the business to further the enforcement, allowing the business to essentially punch the ticket twice.

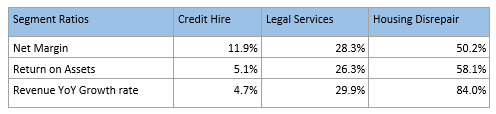

We can see a simple breakdown of bottom-line margin, return on assets and year-on-year revenue growth rate for the 3 segments.

Other Legal Services

Bond Turner legal services division has opportunistically carved a specialist segment within Emissions litigation related to car manufacturers. The company recently settled its inaugural case against Volkswagen in an expedited manner, which allows both parties to avoid expensive, long-winded time in court. The settlement amount of £7.18m, whilst an impressive return on investment for the company was underwhelming as expressed by management. However, they believe this has set a precedent, and should allow for continued cases to be undertaken against a variety of alternative manufacturers, with an active case against Mercedes-Benz currently in progress.

Whilst the revenue from such a segment may seem sporadic and inconsistent, after discussions with management they have expressed their belief that a runway of approximately five or six additional cases can be undertaken up to 2026, thereafter, they are of the belief a similar vein of case can be undertaken against energy companies within the UK. Allowing the business to have an additional high margin, revenue stream to supplement current segments.

Competition & Risks

Competition remains limited, as discussed, the segment that Anexo operates is niche, and many of the characteristics of the nature of the business make it less desirable to say a common law practice. Therefore, the market is segmented across a variety of smaller firms, with Anexo claiming to be the market leader at 2-3%. Management has expressed and I have flagged above, the limitations in growth are related to the volume in which the business can churn, with case backlogs of over 20,000 there appears to be no shortage of availability.

I will therefore concentrate on risks I see within the business, including trends of key metrics, business efficiency and what may occur to allow expected return not to come to fruition.

Margins & Return Metrics

A lack of operating leverage appears to be concern at Anexo, since 2017 the companies operating margin has declined from 34% to 22% and net margin declining from 28% to 14%. Having discussed this with management, during the years post IPO management was seeking to grow revenue through expanding its vehicles-on-hire statistic, whilst this led to revenue growth it came at the cost of margins. These concerns were highlighted at the beginning of the year in Anexo's revised strategy, management feels this can be reversed through targeting a specific number of vehicles-on-hire, as well as cherry picking cases which offer best opportunity to efficiently manage working capital. As legal services become a higher portion of total revenues margins should begin trending higher.

Cash Conversion Cycle

Anexo's business activities by nature rely on the efficiency of the courts and whilst progress has been made in the past 24 months to generate income from additional sources that can provide cash collection in a quicker time frame, the importance of working capital management is ultimately important in Anexo's case. Management is aligned to proper working capital management, as not only are they working within the business but own close to 35% of shares outstanding.

Increasing Liabilities

With an extended cash collection cycle, debt is of course going to play a pivotal role in allowing the day-to-day operations to run smoothly. Since 2020 long-term debt has increased over 200%, with Debt/Equity ratio increasing from 44% to 56%. Increasing liabilities, declining margins and long cash conversion cycle hardly instills confidence, however, in this case, I believe management has been clear on its ability to meet all necessary payments and has emphasized with its improved focus on cash collection the reduction of debt will be a key focus.

Accounts Receivable

Anexo is essentially a net-net, however, most current assets are tied up in accounts receivable. If we are to assume revenue to continue to grow, we must assess the quality and likelihood of realization of the receivables. Management has stressed strict recognition policies on revenues, and this is evident if we are to look at the number of provisions carried forward on accounts receivable. From 2019 to 2022 provisions for the impairment of receivables has decreased from 24% to 17%, this is an important trend to monitor moving forward.

Capital Allocation

I believe to be the most prominent risk, whilst Anexo appears to priced much too cheaply, if management were to take steps in improving margins, debt reduction and potentially increasing dividend payments we could quite easily see the share price re-rate multiple times. However, after discussing capital allocation with management, decision-making, whilst open to suggestions feels like guesswork. They are of the belief their share price is too cheap and reflects negative sentiment in the market. Rather than the possibility that declining margins, increasing debt and poor cash collection could be at the core of the share price decline. At 0.60p I questioned, why not implement a buy-back program with cash on hand, management stated they have pressure from larger UK SMID funds to maintain the dividend. Whilst I understand the importance of maintaining respected funds on the register, management should be seeking the highest return on capital.

Valuation

Management has forecasted declining earnings for 2023 as the business shifts focus to high quality cases and increased cash collections. Modelling out below trend revenues, above trend growth capex and multiple expansion from 3 to 6 (historical average), we could see returns of 125% as share price reaches the low end of fair value range.

I prefer not to rely on forecasting due to the uncertainty in actual possibilities, however, mapping out scenarios and using sub-optimal growth and capex rates provides an additional margin of safety in the valuation.

I will also reiterate, a lightly traded small cap listed on the AIM in the UK, may continue to operate uncovered for some time or may require a substantial catalyst to realize value.

Catalysts

There are a number of catalysts that could begin to unlock value, cash collections have been increasing steadily over the past 5 years, however, optimizing operational efficiency has lacked. The catalysts that need to be monitored to determine whether the business is on the right track to unlocking value and potentially re-rating are as such.

Increasing margins

Increasing return on capital through investment in legal services and specialty cases

Reducing outstanding debt

Growth in dividend yield

Improved UK market sentiment

Another potentially less likely but possible catalyst is the firm being taken out via private equity. DBAY Advisers is the largest shareholder in Anexo Group at 28% ownership. I have discussed this possibility with management after they previously received an offer at £1.50 per share, this was declined. Management feels the intrinsic value of the business is much greater than £1.50, which assumes a 250% from the current share price.

Summary

Anexo is an interesting business that has carved out a segment of the legal services market that is unique and cash generative. The business is not without its challenges and whilst it is not a stock you would stash away in the Buy-and-Hold portfolio, it does appear there is an opportunity to capitalize on a good business at a cheap price. Management have listened to shareholders are now focusing on areas that should drive operational performance. Respected and well-known funds remain on the register and should signs of recovery in margin, EPS and return on capital become visible, the stock could quickly realize value in the coming years.

Please note: This is not financial advice, if interested in investing in Anexo Group please conduct your own research.